A strong enterprise social network can improve innovation in an organization, according to anecdotes and self-reported survey data. But how can we measure more accurately?

Robots Rising: 7 Real-Life Roles

Robots Rising: 7 Real-Life Roles (Click image for larger view and slideshow.)

It seems almost intuitive that having a vibrant enterprise social network would lead to increased innovation within a company. After all, the more visible ideas are to the whole corporation, the more likely some of them will take hold.

But it also seems intuitive that the sun goes around our flat earth. That's why we invented science -- to confirm or correct our intuitions. We do know from academic research that innovation is positively influenced by collaboration, diversity of participants, and shared vision, but whether the use of an enterprise social network (ESN) contributes to any of those is still something of an open question.

Most of the data we have on the success of ESNs comes from self-reported anecdotes, vendor success stories, individual case studies, and surveys. Each of these methods is useful, but each has its drawbacks.

[Would a three-month hiatus from Facebook make you happier? Read Could You Quit Facebook For 99 Days?]

Self-reports and vendor stories will inevitably be painted a shade rosier than they might actually be. Case studies performed by an independent researcher are somewhat better, but still may suffer from survivorship bias or the "file drawer effect," since failures are not as enjoyable as successes for the participants and not as likely to be published by the researcher. Also, it might take quite a few case studies to ensure that any one success is part of a pattern rather than just an anomaly.

Surveys can give a nice cross-sectional view of an industry or marketplace, but most of the social business surveys I have seen rely on responses from CEOs, CIOs, and other executives. Anyone who has worked in a large company knows that the views of executives can often be wildly different from those in the trenches.

Underlying all of these approaches is an even deeper problem: What exactly is innovation? What is collaboration? How can they be defined in ways that are quantifiable and consistent across multiple organizations so that companies can be compared against each other?

I was pondering this a while back and realized there might be a way to tackle this question more quantitatively with readily available public data. Several years ago, the Dachis Group created something it calls the Social Business Index. It tracks thousands of companies and scores them based on data from Facebook, Twitter, YouTube, blogs, wikis, forums, and company announcements.

Granted, it has no way to measure the level of internal social activity for these companies, but there is some evidence that firms that devote the most resources to becoming networked will have both internal and external social business activity, so it might serve as a reasonable proxy.

Patents have been used by researchers for years as a way to measure innovativeness, and the US Patent Office makes its database freely available. Of course there are problems here too -- many companies are highly successful and innovative while producing very little that is patentable. (Think of Walmart.) Also, not all patents are equal. Some provide long-term competitive advantage, while others become worthless shortly after being issued. But it is one way to give a number to innovation.

To control for the Walmart problem, I picked a couple of industries where patents are essential for continued success: computers and medicine. I looked at the number of patents going back only to 2009 because the use of ESNs was not very prevalent prior to that. I also wanted to limit the analysis to companies that are already considered successful, just to make sure that bad management or financial problems weren't swamping the effect of social tools.

The Fortune 500 is an indicator of success. Fortune magazine nicely categorizes its list, so I could easily group several of its categories together in a way that gave me the top 14 computer companies and 12 medical -- computer companies such as Apple, Microsoft, HP, and IBM, and medical firms Baxter, Pfizer, Merck, and Eli Lilly.

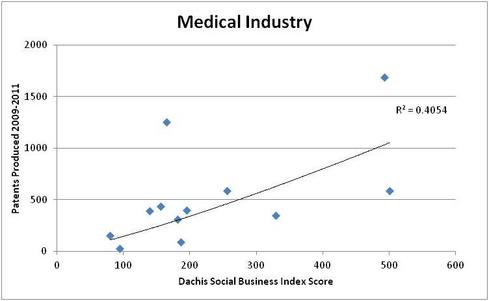

A few hours of data-gathering produced some interesting results:

The best fits in my quick-and-dirty Excel plots were a power curve for the computer industry (note that the graph has a log Y-axis) and an exponential curve for the medical industry -- but they both resulted in almost identical 0.4 R-squared values. One interpretation of this is that the Social Business Index explains 40% of the variability in patents produced.

I'm the first to admit that there are many limitations here, just as with surveys and case studies. My assumption that patent count and SBI score are proxies for innovation and social business activity might not be correct. It could be that companies that generate a lot of patents are already innovative and so are more inclined to use social business tools -- or there might be a third factor that influences both innovation and the use of ESNs. A more sophisticated statistical analysis might result in a weaker relationship.

But the results are intriguing. This analysis is a first step toward trying to measure the benefits of social business quantitatively, and it confirms what the surveys and case studies all say. I thought I would share it to spark some discussion.

I'd love to hear any ideas you might have for other ways to measure the impact, not just on innovation but for other benefits as well. The above analysis is contained in an unpublished paper I wrote as part of my PhD research. I would be happy to send a copy to anyone who wants one. Just email me: [email protected].

Here's a step-by-step plan to mesh IT goals with business and customer objectives and, critically, measure your initiatives to ensure that the business is successful. Get the How To Tie Tech Innovation To Business Strategy report today (registration required).

About the Author(s)

You May Also Like