Processing payroll is a task that touches every business regardless of size -- you've got to pay your people. But making the leap from cutting checks manually to an online payroll services is significant barrier to entry for many small business according to PayCycle's market research.

Processing payroll is a task that touches every business regardless of size -- you've got to pay your people. But making the leap from cutting checks manually to an online payroll services is significant barrier to entry for many small business according to PayCycle's market research.Many business owners operate on the if it ain't broke, don't fix model when it comes to payroll. The advantages of online services -- integration with financial software, tax filing support to name two -- are appealing, but that doesn't always trump the difficulties (perceived or real) of moving to a new system. Particularly, when the price of a gaffe is, at the very least, disgruntled employees.

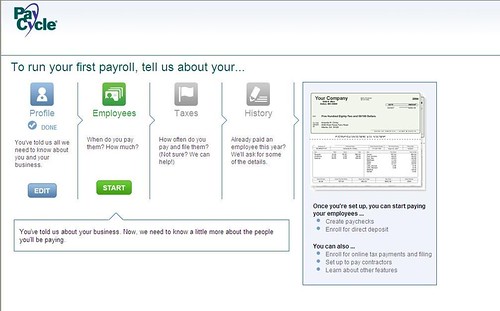

Knocking down that barrier to entry is one enhancement in 2009 release of PayCycle and responds to customer input. Now the setup process follows a familiar wizard format that will have users up and running in 4 steps. And, as PayCycle senior manager of regulatory services, Tina Korabiak, notes, the setup is something that you only do one time.

Also included in the latest release is an export manager that allows users to move data to accounting software, including QuickBooks, and, in play for more business, support for companies with up to 100 employees (increased from the previous 20), and multistate support.

With all the talk of economic bailouts, PayCycle has garnered attention of late for the findings of a survey that found roughly a third (34%) of the clients surveyed favored a stimulus packages specifically for small business when president-elect Obama takes office. The survey, conducted in last month, captured input from more than 300 of PayCycle 75,000 clients.

Also among the findings was a ranking of the issues with the most impact on small business. On this front, 32% pointed to the current financial crisis, more than a fifth (21%) cited the credit and housing crunches, while 18% noted the summer spike in gas prices.

In the face of these issues, the small businesses are tightening their belts. More than half (53%) of those surveyed typically pay yearend bonuses. But not this year, almost 60% of those that usually pay bonuses are foregoing them and 43% are cancelling or scaling back holiday parties.

More From bMighty: Financial Crisis Survival Kit

About the Author(s)

You May Also Like