Is BlackBerry's Passport smartphone a triumph for keyboard loyalists? Or BlackBerry's last hurrah in hardware?

Apple's Next Chapter: 10 Key Issues

Apple's Next Chapter: 10 Key Issues (Click image for larger view and slideshow.)

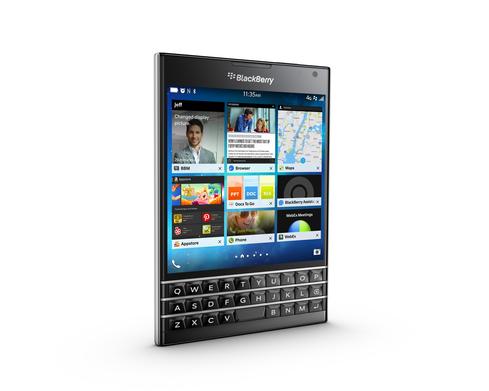

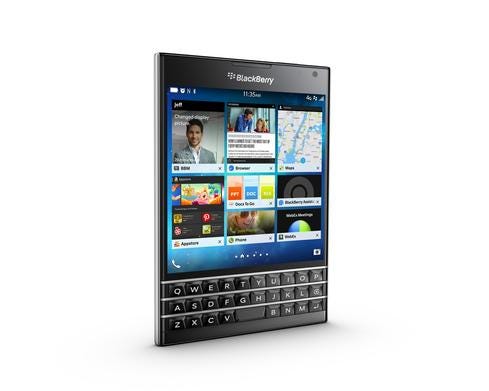

Most days, if BlackBerry references appear in the news, they're part of some cautionary tale about the perils that befall companies that don't innovate. The company hoped to inspire different sentiments this week with the release of its Passport smartphone. Aimed at productivity-minded professionals, the device includes a physical QWERTY keyboard and a unique, square-shaped screen -- both features that BlackBerry CEO John Chen said will help enterprise users get more done.

With the launch last year of its Z10 touchscreen smartphone, the company tried and failed to blend mainstream features with its business-oriented strengths. The Passport reverses this course, with enterprise use informing almost all aspects of its design.

The 4.5-inch screen allows websites and documents to render more horizontal content; spreadsheets, for example, will display more columns on the Passport than on most other smartphones. With 1,440-by-1,440-pixel resolution, the screen boasts an impressive 453 ppi, as well as protection from Corning's Gorilla Glass 3.

The device is about the same size as a physical passport. It weighs 6.9 ounces and includes 3 GB of RAM, 32 GB of storage, a 2.2GHz quad-core Snapdragon processor, and the largest battery of any smartphone currently available. The battery isn't removable, which is a departure from traditional BlackBerry models, but the company says the Passport will handle up to 30 hours of mixed use between charges.

Figure 1:

Available for $599 unlocked via BlackBerry's website and $250 through carriers with a two-year contract, the Passport includes several software features designed for enterprise use. It runs the BlackBerry 10.3 OS, which will come to compatible smartphones at a later date. The OS offers tools such as Blend, which allows users to share content and messages between a smartphone and a PC or tablet, and BlackBerry Assistant, the company's answer to Siri, Cortana, and Google Now.

But is BlackBerry poised for a comeback? Here are four big challenges the company will have to overcome.

1. The user interface might be divisive, even for the Passport's intended users.

The Passport's physical keyboard spans only three rows and doesn't include all the keys that longtime BlackBerry users might expect. It offers only letters, a space bar, a return key, and a delete key. Numbers and punctuation characters are accessed via soft keys that appear at the bottom of the Passport's screen, just above the physical keyboard.

BlackBerry claims this setup allows for quicker and more accurate typing, but

some reviewers with pre-release access to the device have opined that touchscreen keyboards are actually faster and more comfortable.

The keyboard is not as potentially troubling as the Passport's square screen, though. Even spreadsheet power users like to play games or watch movies occasionally on their phones, and the Passport aspect ratio is a clear compromise.

2. Almost no one makes money-making smartphones.

BlackBerry execs admit that the Passport isn't a mass-market product, yet CEO Chen told The New York Times that, if the company's hardware efforts aren't profitable, the company will stop making phones. Is Chen effectively admitting that the Passport is a last-ditch effort before the company focuses entirely on software and security products? It's hard to imagine BlackBerry making much money from its newest phone.

To be profitable in the smartphone market, a company generally needs to sell a lot of high-margin devices -- which is why Apple is the only company that's any good at squeezing money out of smartphone manufacturing. It's also why most smartphone OEMs position their devices as ecosystem plays, in which low- or negative-margin device sales are offset by high-margin tangential benefits, such as user subscriptions to mobile services.

For BlackBerry, the Passport's $599 unlocked cost doesn't imply outstanding margins. The cheapest iPhone 6 model costs only $50 more, but BlackBerry, as a low-volume smartphone player, doesn't have anywhere near Apple's clout among component suppliers and manufacturing partners. Chen told the NYT that BlackBerry has attempted to limit costs by using some commodity components found in the majority of smartphones and by forging new relationships with manufacturers. But even if BlackBerry is controlling costs, it could struggle for volume (see item 4 for more).

3. Even enterprise professionals like apps.

The Passport's square screen isn't ideal for those who run lots of apps. The operating system doesn't help matters. It has access both to native BlackBerry apps and to Android apps available through Amazon's app store -- but apps written for typical, rectangular smartphone screens aren't going to scale well. Moreover, because BlackBerry 10.3 doesn't have access to the full Google Play catalogue, many popular apps aren't available. Is BlackBerry the only smartphone player that realizes some users care more about physical keyboards than smartphone apps? Or has the company forgotten that even serious-minded enterprise professionals become regular consumers outside of business hours?

This issue has farther-reaching problems, as well. iPhones are popular at work because the iOS app ecosystem evolves so rapidly. The iPhone's work value isn't just due to Apple's OS and product design; it's also due to the many contributors who are constantly building new apps for the platform. With less developer investment, the Passport experience is less likely to add new ideas over time.

4. The professional market has spoken.

If there's one fatal flaw in BlackBerry's approach, it's this: Many of the professional users whom the Passport targets are the same people who helped iOS rise to prominence. iPhones are relatively affordable today, but the devices launched at higher prices are still most popular among affluent customers. There's meaningful overlap between the high earners who've continued to buy iPhones and the professionally minded demographic that BlackBerry hopes to reach. After all, BYOD programs started partly because executives wanted IT departments to support their new iPhones and iPads. Given that many enterprise workers have made clear their preference for modern smartphone experiences, can BlackBerry possibly lure back enough users?

The Internet of Things demands reliable connectivity, but standards remain up in the air. Here's how to kick your IoT strategy into high gear. Get the new IoT Goes Mobile issue of InformationWeek Tech Digest today (free registration required).

About the Author(s)

You May Also Like