AWS Summit Highlights AI, Nasdaq and Bayer Use Cases, and ChipsAWS Summit Highlights AI, Nasdaq and Bayer Use Cases, and Chips

Matt Wood's keynote showed the role of the cloud in AI development, crop science, financial markets, and how chipmaking intersects with cloud services.

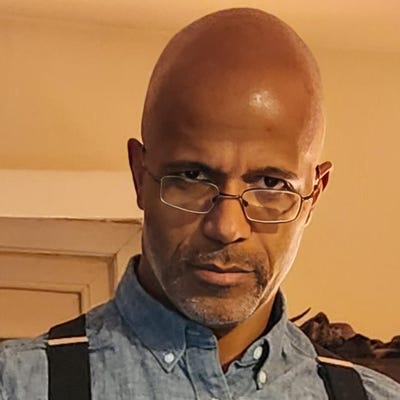

On Wednesday, Matt Wood, vice president of AI products at AWS, led the keynote at the AWS Summit New York that included a look at how cloud resources are part of AI development, support financial markets, and have a hand in crop science.

The summit typically features a flurry of announcements from AWS on product launches and service updates. Woven into the keynote were elements that could have significance across cloud and industry segments. For example, Wood touted the numerous customers running their AI and machine learning workloads on AWS. While many of those customers seemed likely candidates to pursue AI, he pointed out a sector that was making quick moves to jump on board.

“We are seeing a group of customers that are moving slightly faster than the average and these are the customers in regulated industries -- regulated industries like financial services with the New York Stock Exchange, insurance companies like Sun Life, life science companies like Pfizer, and even in the public sector in the healthcare space with the District of Columbia Department of Health,” he said. “And the reason why these customers are able to move so quickly in their generative AI journey is because they’ve been able to meet the compliance of these regulations over the last 20 years or so, and that regulatory compliance has actually driven all the right behaviors to be able to use generative AI.”

This includes having a robust data strategy, understanding the quality of data, and understanding the governance of their data, Wood said. That made the move to using generative AI more of an incremental lift for those institutions.

He talked up the longstanding relationship between AWS and Nvidia -- the use of its GPUs as well as other resources -- then segued into a talk about some of the chip efforts within AWS itself as the company has grown. “It’s why we have so many different instance types that you can choose from with different mixtures or accelerators and CPUs and memory and storage,” Wood said. “Having access to different options allows you to find the best fit for your needs. And because of that, we’ve been investing in our own chips for years, including general-purpose processors like Graviton, but also custom-built accelerators for machine learning and AI.”

AWS’s Inferentia chip is built for inference, he said, and the Training chip is built to accelerate the inner loop of machine learning and AI training. Both chips are in their second generation, Wood said.

The keynote eventually shifted to some notable users who discussed how they leveraged the cloud provider’s resources, including in pursuit of AI development. “AI has the potential to power a new generation of growth, faster and more powerful than any technology we’ve seen before,” said Brad Peterson, executive vice president, CTO, and CIO for Nasdaq.

He spoke on Nasdaq’s efforts as a disruptor in the financial system, and how it has evolved with its focus on technology. “It’s why we were early adopters in the cloud and it’s why we’re really well positioned to leverage AI,” Peterson said. “You heard that data is at the center of this. So really understanding and having your data well positioned, hence especially well positioned and structured in the cloud, is one of the best things that you can do.”

Years back, Nasdaq developed SAS-based cloud products with its data, then eventually considered moving one of its most demanding markets -- its US equity derivatives markets -- to the cloud. “We’ve continued to launch exchanges, and this resulted in what is really a high-performance, edge-compute cloud for capital markets,” he said. “This is actually a new trend you can see that really cloud regions are being extended to the edge and they need to be extended for many industries.”

This includes manufacturing, which needs processing, and low latency performance extended into factories, Peterson said.

Later in the keynote, Will McQueen, vice president and head of crop science data assets and analytics with Bayer Crop Science, spoke about the challenge of food scarcity as the world population continues to expand. “How do we meet the growing demand for crop production while still being good stewards of the planet?” he asked. “It’s not enough to have a net-zero impact. We need to have a positive impact.”

He said the crop science division of Bayer aims to deliver on a strategy. “First, we need to scale regenerative agriculture. That means focusing on a zero-carbon future, reducing our environmental impact, and even smaller farming.” Increasing food production, improving water usage, and other efforts are part of the strategy that includes the use of digital solutions, McQueen said. “Bayer is no stranger to embracing digital adoption of cloud capabilities and prioritizing a strong focus on modern technical platforms, including data and analytics.” He said the company has been developing solutions on AWS since 2014 and there is more work ahead, tapping AI to help address the growing complexity of sustainability and food shortages.

“We need to accelerate,” McQueen said. “We need to surface our data science capabilities in a way that both promotes and enables reuse. And within the last year, our focus is moving rapidly toward leveraging GenAI to take us into the future.”

About the Author

You May Also Like