Gartner finds server shipments fell in the first quarter, but conditions are leveling off and Chinese vendors are on the rise.

The patient is still in intensive care, but his condition isn't as bad as it was until recently. That's the glass-half-full assessment Gartner used to sum up its worldwide server shipment and revenue report for the first quarter of 2014.

"After some challenges in 2013, vendors will be relieved to see 2014 get off to a relatively good start," said Adrian O'Connell, research director at Gartner, in a statement. "The demand environment is stabilizing but challenges remain. We are likely to see revenue growth in 2014, but the reality is that the market is operating from a significantly lower level than it was prior to the downturn in 2008."

[So what is IBM's hardware revival plan? Read IBM Unveils Power8 Chip As Open Hardware.]

The "challenges" that remain include continued declines in sales of non-x86 servers. RISC/Itanium Unix server shipments were down 19.9% while vendor revenues in this category fell 16.9% from Q1 2013. This continues a trend whereby defections to x86 servers have hit RISC/Itanium Unix server lines including HP Itanium, IBM Power, and Oracle Sparc. But here, too, Gartner says there's reason for hope.

"Platform migrations continued to be a factor, but the rate of these declines has slowed and the worst rates of decline may be behind us," said O'Connell.

IBM troubles have been compounded by a precipitous decline in hardware sales in China, where the company is widely seen as the victim of a growing dispute between the US and China. BusinessWeek reported Tuesday that the Chinese government is reviewing whether domestic bank reliance on high-end servers from IBM compromises the nation's financial security. The move comes in the wake of last year's revelations by former contractor Edward Snowden of large-scale National Security Agency spying programs.

Tech industry watchers say the spying revelations have crimped US vendor sales worldwide, but the new Chinese government review comes one week after American prosecutors indicted five Chinese military officers for allegedly hacking into the computers of US companies. Chinese agencies, including the People's Bank of China and the Ministry of Finance, are asking banks to remove the IBM servers and replace them with a local brand as part of a trial program, according to BusinessWeek.

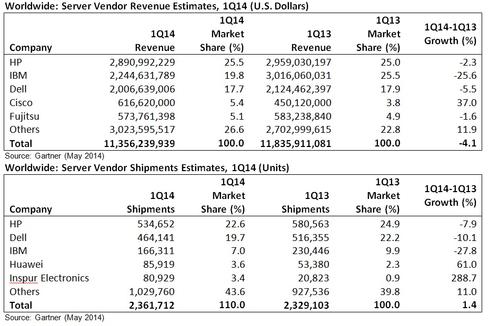

"Local" server brands in China include x86 server makers Huawei and Inspur Electronics, which were the only vendors among the top five in Gartner's report to show increased shipments in the first quarter of 2014, with growth of 61% and 288.7%, respectively. This is the first time Inspur made it into the top five in server shipments.

The x86 server market was stable in the first quarter, with growth of 1.7% in shipments and a 2.8% increase in revenue year over year. x86-focused Cisco was the only company in the top five that increased revenue in the first quarter of 2014, with growth of 37% compared with the same quarter in 2013.

HP remains the worldwide server market leader, with $2.9 billion in revenue in the first quarter, but its market share was down 2.3% from the same quarter in 2013, to 25.5%.

Our InformationWeek Elite 100 issue -- our 26th ranking of technology innovators -- shines a spotlight on businesses that are succeeding because of their digital strategies. We take a close at look at the top five companies in this year's ranking and the eight winners of our Business Innovation awards, and offer 20 great ideas that you can use in your company. We also provide a ranked list of our Elite 100 innovators. Read our InformationWeek Elite 100 issue today.

About the Author(s)

You May Also Like