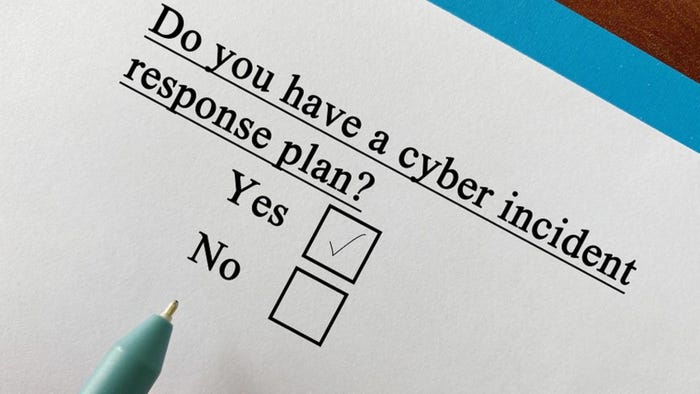

cyber incident checklist image

IT Leadership

3 Steps Executives and Boards Should Take to Ensure Cyber Readiness3 Steps Executives and Boards Should Take to Ensure Cyber Readiness

Many teams think they're ready for a cyberattack, but events have shown that many don't have an adequate incident response plan.

Never Miss a Beat: Get a snapshot of the issues affecting the IT industry straight to your inbox.