Yahoo To Lay Off 15% Of Workforce, Hints At Sale Of Assets

Yahoo said it plans to cut 15% of its workforce and hinted at selling its non-strategic assets. Another strong indication that change is afoot is the resignation of a high-profile board member -- the second one in the past two months.

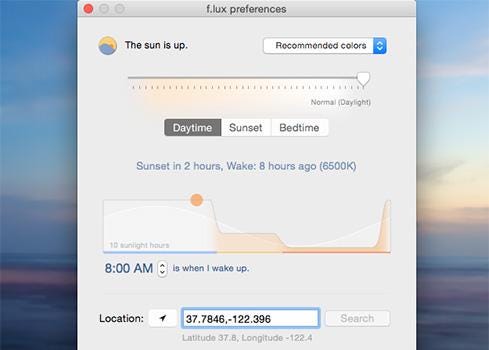

10 Productivity Tools To Help You Win At Work

10 Productivity Tools To Help You Win At Work (Click image for larger view and slideshow.)

Yahoo laid out plans to cut 15% of its workforce -- approximately 1,700 jobs -- amid a restructuring to narrow the company's focus, as well as to potentially sell some of its non-strategic assets, the company announced Tuesday. Another strong indication that change is afoot is the resignation of board member Charles Schwab. News that Schwab will be stepping down immediately came at the same time earnings were released Tuesday. He is the second Yahoo board member to part ways with the company in the past two months.

Yahoo's layoffs, restructuring, potential asset sale, and the departure of its two board members point to a company that is desperately trying to appease its disgruntled shareholder Starboard Value, which has threatened to wage a proxy fight unless the company is taking certain measures to increase its value.

Changes Starboard is seeking include ditching its current management, namely Yahoo CEO Marissa Mayer, retooling the composition of the board to include some of Starboard's representatives, and taking on a new strategy that largely calls for the outright sale of Yahoo's core assets. And the deadline to appease this investor is fast approaching.

Between Feb. 25 and March 26, Starboard Value can launch a proxy fight, in which it puts forth the names of opposition candidates to run for a seat on Yahoo's board, with the hope it can take over a majority of the seven board seats. As a result, it would not be surprising to see Yahoo enact other changes to its operations in the coming months.

One possible outcome is Yahoo extending an invitation to Starboard to take the vacated board seats left by Schwab and Max Levchin, who stepped down in December, in the hope that that gesture alone would appease the activist shareholder. Chances are, however, it probably won't since Starboard has some fairly large requests on the table.

In a Jan. 6 letter to Yahoo's board of directors, Starboard stated:

The Board must accept that significant changes are desperately needed. This would include changes in management, changes in Board composition, and changes in strategy and execution. If the Board is willing to embrace the need for significant change and pursue a strategy along the lines of what we have proposed above, we are hopeful we can work constructively together and make changes to the Board through a mutually agreeable resolution. This is clearly the preferable route. If the Board is unwilling to accept the need for significant change, then an election contest may very well be needed so that shareholders can replace a majority of the Board with directors who will represent their best interests and approach the situation with an open mind and a fresh perspective.

Yahoo, however, is optimistic it can ramp up its profitability and growth with its restructuring and layoffs. The company expects to save $400 million in annual in operating expenses by reducing its workforce by 15% as well as shutting offices in Dubai, Mexico City, Buenos Aires, Madrid, and Milan. Yahoo said that it anticipates having roughly 9,000 employees and 1,000 contract workers by the end of the year.

As part the restructuring, Yahoo will focus on three platforms -- search, mail, and Tumblr -- along with four content areas: news, finance, sports, and lifestyle. Yahoo plans to consolidate some of its digital magazines into one of its four content areas, while other digital magazines will be shut down.

Yahoo also said that it is exiting legacy products, including games and Smart TV, that have not met growth expectations.

Yahoo's product portfolio will also be trimmed, with the struggling company seeking to potentially sell some of its non-strategic assets and real estate. The company estimates those sales could lead to a potential cash windfall of $1 billion to $3 billion.

The embattled Internet pioneer is also seeking to drive further revenue growth with its mobile, video, native, and social business, which it calls Mavens. The company aims to grow Mavens' revenue to $1.8 billion this year.

[ Read Yahoo Releases Massive Data Set To Academic Institutions. ]

"This is a strong plan calling for bold shifts in products and in resources," Mayer said in a statement. "We are extremely proud of the billion dollar plus business we have built in mobile, video, native, and social. Our strategic bets in Mavens have enabled us to build an entirely new, forward-leaning business of tremendous scale and growth in three years."

In addition to Yahoo's plans to potentially seek a buyer for its non-strategic assets, there may be a hint that the company is looking at doing more than just a non-strategic sale of the assets and may entertain a sale of the company and its core assets.

"The board is committed to the turnaround efforts of the management team and supportive of the plan announced today," said Yahoo chairman of the board Maynard Webb, in a statement Tuesday, adding, "The board also believes that exploring additional strategic alternatives, in parallel to the execution of the management plan, is in the best interest of our shareholders."

Are you an IT Hero? Do you know someone who is? Submit your entry now for InformationWeek's IT Hero Award. Full details and a submission form can be found here.

About the Author(s)

You May Also Like

How to Amplify DevOps with DevSecOps

May 22, 2024Generative AI: Use Cases and Risks in 2024

May 29, 2024Smart Service Management

June 4, 2024