Google Search Fuels First Quarter Earnings For Alphabet

Alphabet posts a solid first quarter that was fueled by its core search business and YouTube. But cloud and enterprise remain in sharp focus for future growth.

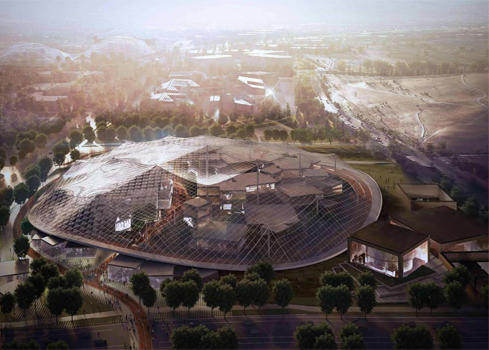

Google's Next HQ: Modern, With Retro Flairs

Google's Next HQ: Modern, With Retro Flairs (Click image for larger view and slideshow.)

Alphabet Thursday turned in strong first-quarter results, as its search and YouTube businesses continued to fuel growth.

But the Internet giant is also keeping a sharp eye on other growth opportunities, with cloud and enterprise representing a key focus, say analysts.

Alphabet, which posted a 17% increase in revenue to $20.3 billion in the first quarter over the previous year, noted some of its revenue growth was also driven by an increase in its cloud and apps sales, as well as Google Play and a small contribution from its new Chromecast and Nexus device launches, according to a Barclays analyst report provided to InformationWeek.

The importance that Alphabet is placing on Google's cloud and apps is evident by its investment into this area by its research and development department. Barclays, in citing the highlights from Alphabets first-quarter conference call, stated in its report:

R&D growth was related to increased headcount with the majority of new hires being engineers and product managers for Cloud and Apps. The company plans to continue to invest in headcount within the Cloud/Apps business.

The company called out machine learning capabilities and being able to understand an Enterprise's data as a point of differentiation for (Google Cloud Platform) GCP, while acknowledging that many Enterprises will likely live in a multi-cloud world.

Andrew Frank, a Gartner analyst, said Alphabet's earnings helped clarify why it is important for Google to move in the direction of enterprise software, especially with such offerings as Google Analytics Suite 360 that helps it leverage its scale.

"Google will have difficulty sustaining growth in its traditional self-service ad business as the world goes mobile and Facebook asserts its ad power," Frank said in an interview with InformationWeek. "Enterprise is an important new battleground as marketers take more control of their advertising."

He added that while search has brought Google amazingly far and will continue to be important to Alphabet, it is clear that the company is reaching a phase of maturity that necessitates diversification.

Create a culture where technology advances truly empower your business. Attend the Leadership Track at Interop Las Vegas, May 2-6. Register now!

But Trip Chowdhry, an analyst with Global Equities Research, said his opinion on Google's cloud efforts remains unchanged, despite its first-quarter report.

He maintains his view that he expressed earlier in the month that "investor optimism on Google Cloud is premature" and that it is a "baby" compared to Amazon's AWS cloud service, according to his report on Alphabet's first quarter performance provided to InformationWeek.

The report notes he is not optimistic that Google Cloud will ever catch up to AWS. Chowdhry notes in his report that can only happen if this event occurs. "Yes, provided AWS stops innovating, which is highly unlikely -- as AWS innovation velocity far exceeds that of (Google) Cloud," he noted in the report.

Alphabet's Bread and Butter

Analysts across the board pointed to Google search and YouTube as driving Alphabet's revenues. According to a Goldman Sachs report provided to InformationWeek, the analysts there said:

Strength in core search once again drove growth in the quarter. Mobile search continues to be the primary driver, with management also calling out strength in desktop and tablets. YouTube ad revenue also continues to be a significant contributor to growth and, along with mobile, resulted in paid clicks growth of 29% (year over year).

Meanwhile, J.P.Morgan noted in an analyst report provided to InformationWeek that Alphabet's ability to generate advertising revenue from mobile ads posted on its pages is still "relatively early in the game with potential for greater growth down the line. J.P.Morgan also held a similar view on YouTube and its ability to capture more video advertising dollars that are shifting online.

J.P.Morgan, however, issued a warning. "We thought Google's tone was more cautionary around the back-half of (2016)...but we still think there is considerable room to improve mobile monetization over time."

About the Author(s)

You May Also Like

How to Amplify DevOps with DevSecOps

May 22, 2024Generative AI: Use Cases and Risks in 2024

May 29, 2024Smart Service Management

June 4, 2024